App Center

Topia

Leverage SAP Concur Data for Business Travel and Distributed Work Compliance with Topia

Why use Topia with Concur Travel & Expense?

- Identify risks instantly before travel is booked and comply with new regulations

Pre-travel risk assessments help you understand any immigration, tax, social security and associated risks before employees book travel. Topia’s technology can help you stay compliant with rapidly evolving cross border regulations (ie. EU Posted Workers Directive).

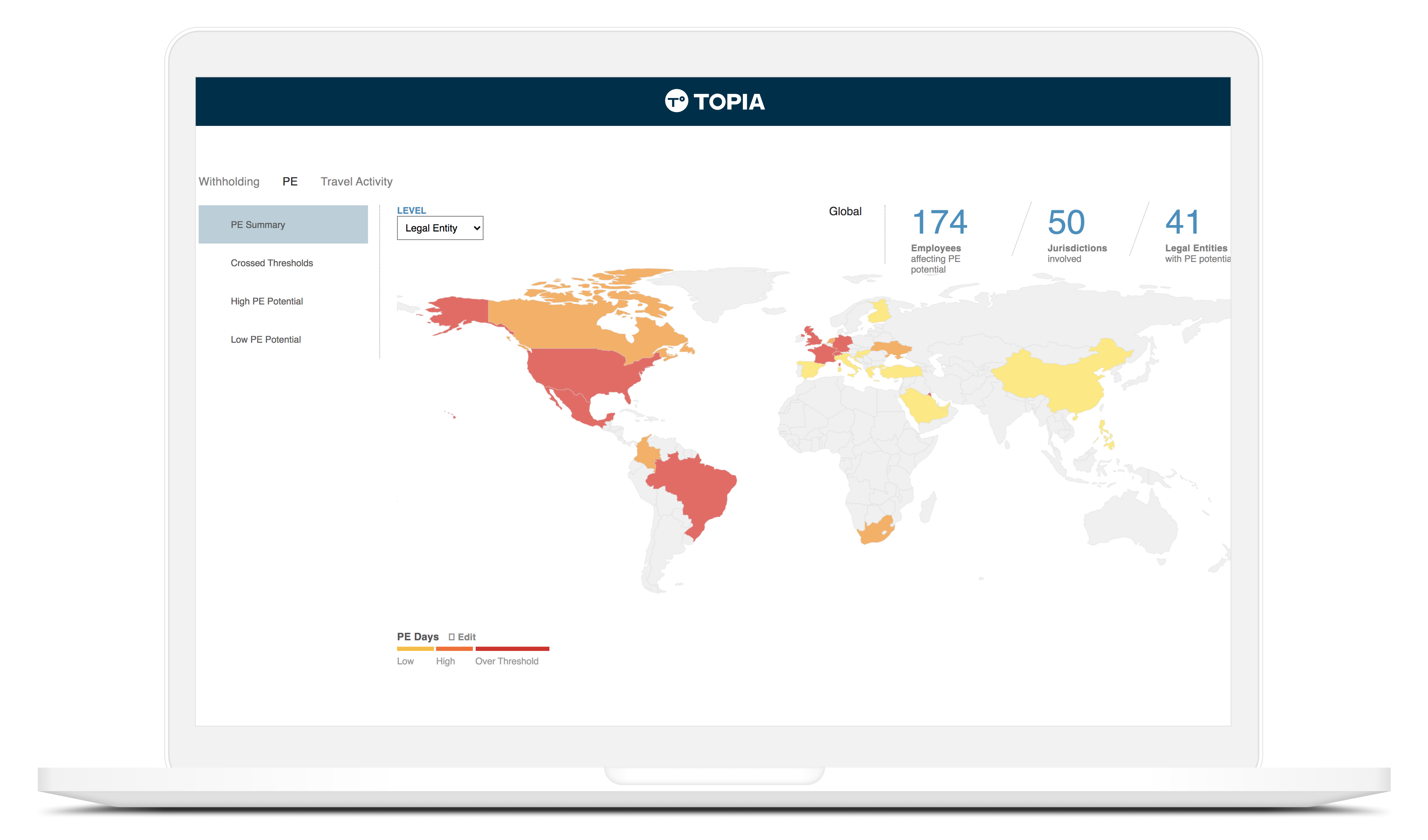

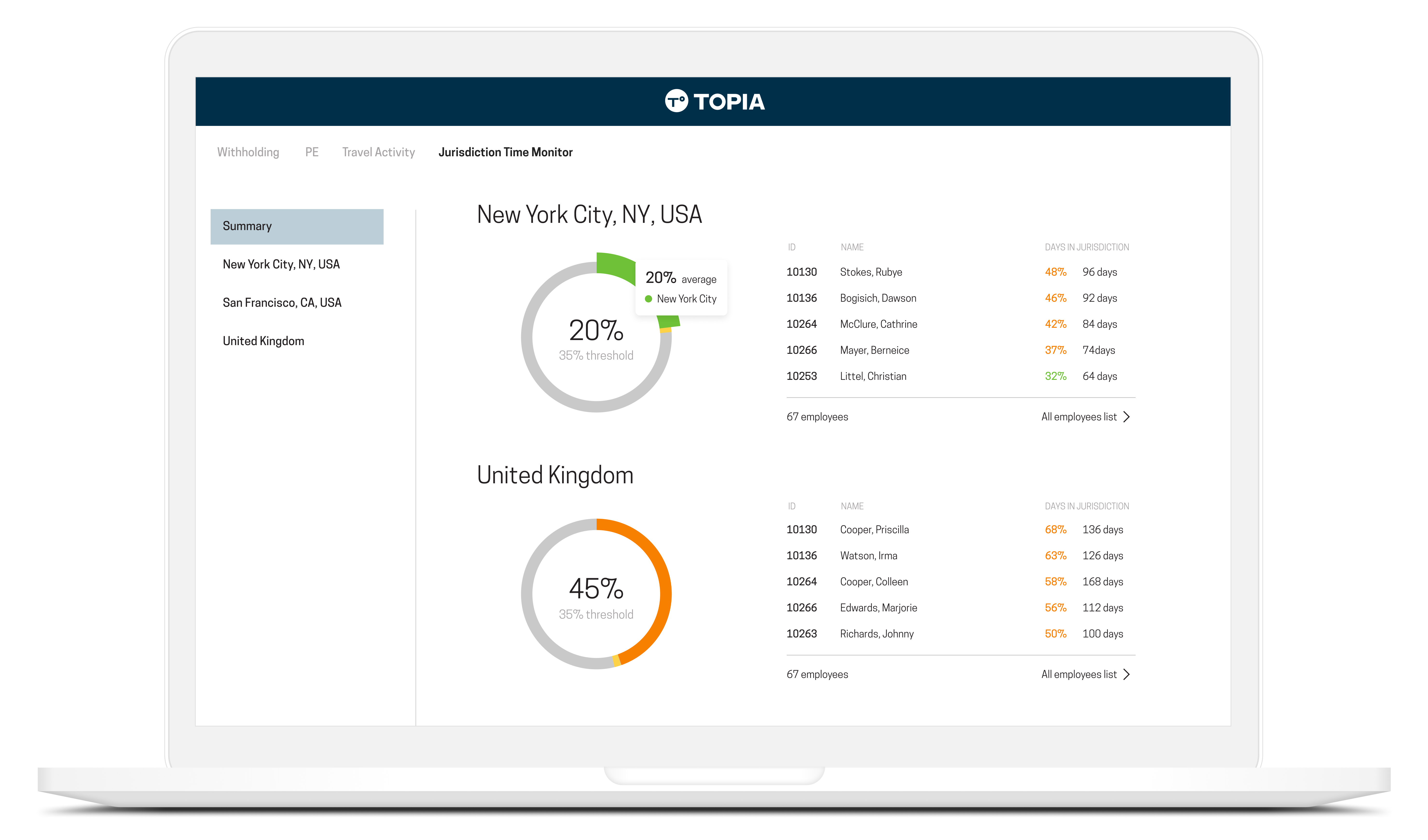

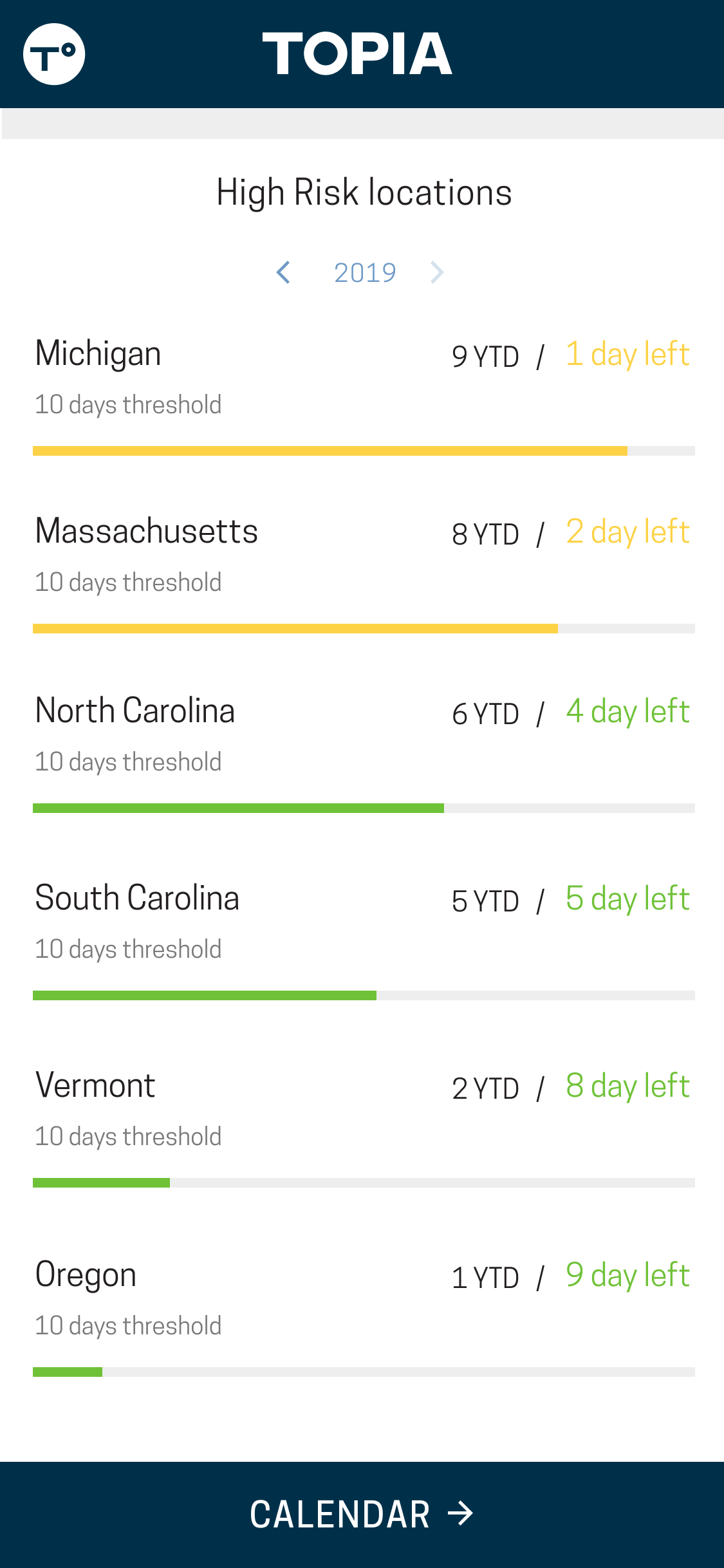

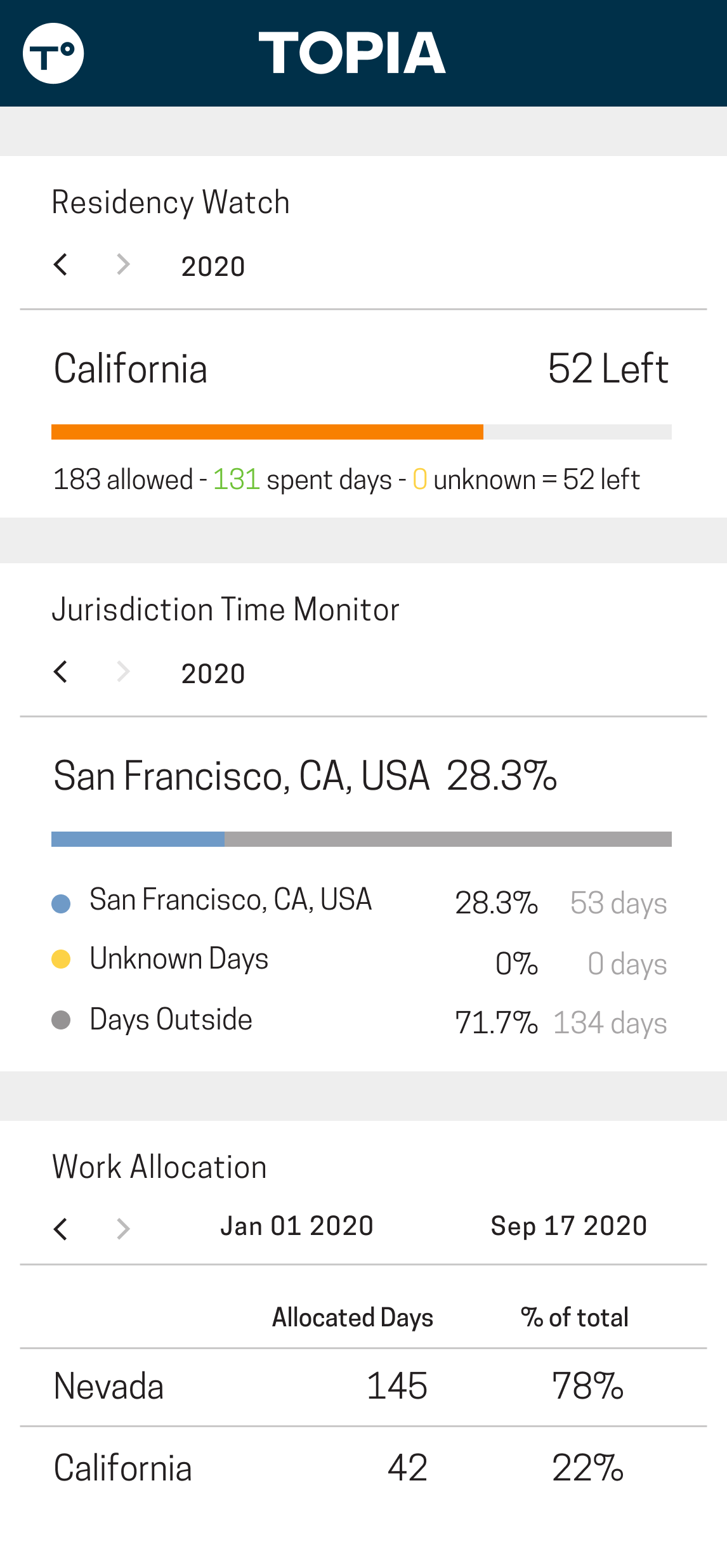

- Simplify volumes of Concur Travel & Expense data into actionable dashboards with alerts

Dashboards show your employees’ work locations and travel footprints at a glance and embedded alerts warn you of growing risks before limits are reached. Manage Permanent Establishment risk and Payroll Tax withholding apportionment with configurable thresholds reflecting your company’s risk tolerance.

- Save time and money

Reduce the time spent on typical tax compliance processes. Prevent reputational damage due to expensive audits and fines by refining your SAP Concur data for compliance purposes. Reduce travel re-bookings and misspend while eliminating costly and error-prone manual data gathering exercises. Optimize local city tax obligations due to the expanded work locations of your distributed workforce outside of city jurisdictions.

- Proven velocity to customer value

Travel is already complicated; your chosen technology and implementation does not have to be. Topia’s in-house professional services team leverages the SAP Concur API-based connector and will rapidly configure to your specifications with no added, future consulting fees.

Business Benefits:

- Proactively assess travel that may require supporting documentation (A1 certificates, visas, work permits, etc.)

- Real-time visibility into your company’s travel footprint / work location and tax liabilities.

- Customizable thresholds to reflect your company’s tax stance / policies (for both domestic (state-to-state) and / or international travel.

- Early alerts warn you of current and growing tax risks.

- Robust dashboards and reports for the insights you need.

Customer Testimonials:

“It was incredibly obvious that Topia Compass was what we wanted. It’s a complete solution – the system is doing everything for you and that’s incredibly appealing.” – Director of Payroll, Global Retail Company

“We like that Topia Compass can interface directly with SAP Concur. My Internal Audit team has found great value in this project.” – Tax Director, Financial Services Company

- Expense - Standard

- Expense - Professional

- Travel - Standard

- Travel - Professional

- 앵궐라

- 앤티가 바부다

- 아루바

- 바하마

- 바베이도스

- 버뮤다

- 캐나다

- 케이맨 제도

- 코스타리카

- 도미니카

- 도미티카공화국

- 엘살바도르

- 그레나다

- 과들루프

- 과테말라

- 아이티

- 온두라스

- 자메이카

- 마르티니크

- 멕시코

- 몬트세라트

- 네덜란드령 앤틸리스 제도

- 니카라과

- 파나마

- 푸에르토리코

- 생바르텔르미

- 세인트키츠네비스

- 세인트루시아

- 생마르탱

- 세인트피엘미켈론

- 세인트빈센트 그레나딘

- 상투메프린시페

- 트리니다드토바고

- 터크스 케이커스 제도

- 미국

- 영국령 버진아일랜드

- 미국령 버진아일랜드

- 아르헨티나

- 벨리즈

- 볼리비아

- 브라질

- 칠레

- 콜롬비아

- 에콰도르

- 포클랜드 제도(말비나스)

- 프랑스령 기아나

- 가이아나

- 파라과이

- 페루

- 세인트헬레나

- 사우스조지아 사우스샌드위치 제도

- 수리남

- 우루과이

- 베네수엘라

- 아프카니스탄

- 올란드 제도

- 알바니아

- 알제리

- 안도라

- 앙골라

- 아르메니아

- 오스트리아

- 아제르바이잔

- 바레인

- 건지 섬

- 벨라루스

- 벨기에

- 베냉

- 보스니아 헤르체고비나

- 보츠와나

- 불가리아

- 부르키나 파소

- 부른디

- 카메룬

- 카보베르데

- 중앙 아프리카 공화국

- 차드

- 콩고 민주 공화국

- 콩고

- 코트디부아르(아이보리 코스트)

- 크로아티아

- 사이프러스

- 체코 공화국

- 덴마크

- 지부티

- 이집트

- 적도 기니

- 에리트레아

- 에스토니아

- 에티오피아

- 유럽 연합

- 페로 제도

- 핀란드

- 프랑스

- 가봉

- 감비아

- 그루지야

- 독일

- 가나

- 지브롤터

- 그리스

- 그린란드

- 교황청(바티칸 시국)

- 헝가리

- 아이슬란드

- 이라크

- 아일랜드

- 이스라엘

- 이탈리아

- 요르단

- 케냐

- 쿠웨이트

- 라트비아

- 레바논

- 레소토

- 리베리아

- 리비아

- 리히텐스타인

- 리투아니아

- 룩셈부르크

- 마케도니아

- 말라위

- 말리

- 몰타

- 모리타니아

- 모리셔스

- 마요트

- 몰도바

- 모나코

- 모로코

- 모잠비크

- 나미비아

- 네덜란드

- 니제르

- 나이지리아

- 노르웨이

- 오만

- 파키스탄

- 폴란드

- 포르투갈

- 카타르

- 루마니아

- 러시아

- 르완다

- 산마리노

- 사우디아라비아

- 세네갈

- 유고슬라비아

- 세르비아 몬테네그로

- 세이셸

- 시에라리온

- 슬로바키아

- 슬로베니아

- 소말리아

- 남아프리카 공화국

- 남수단

- 스페인

- 수단

- 스발바르 잔 마예 제도

- 에스와티니

- 스웨덴

- 스위스

- 탄자니아

- 토고

- 튀니지

- Turkey

- 우간다

- Ukraine excluding Crimea Region/Sevastopol, the so-called Donetsk People’s Republic (DNR) / Luhansk People’s Republic (LNR)

- 아랍 에미리트 연합국

- 영국

- 예멘

- 자이르

- 잠비아

- 짐바브웨

- 미국령 사모아

- 호주

- 방글라데시

- 부탄

- 영국령 인도양 식민지

- 브루나이

- 캄보디아

- 캐롤라인, 마리아나, 마샬 군도

- 중국

- 크리스마스 섬

- 코코스(킬링) 제도

- 코모로

- 쿡 제도

- 동티모르

- 미크로네시아 연방공화국

- 피지

- 프랑스령 폴리네시아

- 프랑스령 남부 지역

- 괌

- 기니

- 기니비사우

- 허드 맥도널드 제도

- 홍콩

- 인도

- 인도네시아

- 존스턴 환초

- 카자흐스탄

- 키리바시

- 대한민국

- 키르기스스탄

- 라오스

- 마카오

- 마다가스카르

- 말레이시아

- 몰디브

- 북마리아나 제도

- 마셜 제도

- 몽고

- 미얀마

- 나우루

- 네팔

- 뉴칼레도니아

- 뉴질랜드

- 니우에

- 노퍽 섬

- 팔라우

- 팔레스타인

- 파푸아뉴기니

- 필리핀

- 피트케인

- 레위니옹

- 사모아

- 싱가포르

- 솔로몬 제도

- 스리랑카

- 대만

- 타지키스탄

- 태국

- 토켈라우

- 통가

- 투르크메니스탄

- 투발루

- 미국령 소군도

- 우즈베키스탄

- 바누아투

- 베트남

- 윌리스 푸투나 제도

- 서사하라